INTRODUCE

- PERSONAL RISK MANAGEMENT

"Around the globe research has shown that there has been no holistic approach to consolidating all risks and lifestyle exposures. Until now, with the latest in technology and know-how, we are now able to bring all ‘risk’ exposures, along with their potential impact and controls/solutions into one place and manage each in a structured and formalised process, thereby giving you have peace of mind and greater security."

The offering is the innovative and global first approach in providing clients with a methodology and process to ‘understanding’ their risk exposures and being able to proactively provide a control/solution to any risk or consequence of a risk materialising. All risk controls and interventions of personal and health related exposures are designed to respond timeously in the event of an exposure or claim materialising. With one point of contact, as a private client, you could work directly with the key specialist consultant or his/her senior associate.

When considering longevity, no matter the age to which each wishes to live, every individual would prefer to live a life with optimal health and wellbeing than spending their last years in a dis-eased state. Surveys around the world have shown that health is the number one concern for not only those that have achieved financial success in business, but all people. The general problem, while achieving financial success, is the unintentional lack of effort and time each individual puts aside for nourishing and caring for themselves, resulting in a compromised immunity, rapid aging and a dis-eased state of being in body, mind and spirit.

To overcome this, the pharmaceutical and health industry has provided numerous solutions in the form of a band-aid under the disguise of medication and treatments to compensate and presumably heal a compromised human health system. However, the medication taken over the years pose numerous other health threats and medical issues which are not always properly communicated too, and considered by the patient.

Statistics reveal that there is up to a 50% probability that one will develop cancer today. Fast forward to 2020, it is projected that everyone will develop cancer.

With cancer being the number 2 cause of premature death in the USA population, closely related to the working population in South Africa, how does one prevent oneself from developing one or more of over 200 different types of cancers?

Some cancer’s being so destructive, that death is inevitable within weeks or months. Should one develop cancer, what is the action plan for treatment? Is it chemotherapy, radiation or alternative treatments? Or is it better to prevent the fall of cancer on one?

When it comes to the wellbeing and functioning of an individual, how is this same principle addressed? It is our work, along with our integrative medical practitioners, to provide guidance in how to optimise one’s health and wellbeing and in doing so ward off any potential disease.

STEP 01

DETERMINE CONTEXT

- Investment management

- Financial planning

- Personal health & wellbeing

- Insurable Exposures

- Retirement Planning

- Security & Intelligence

STEP 02

IDENTIFY & EVALUATE RISK

- Risks identified

- Risk prioritised

- Risks selected on inherent assessment

- Root-cause analysis

- Risk evaluated

- Risk quantified financially

STEP 03

DETERMINE CONTROLS

- Determine existing control

- Determine control gaps

- Determine control improvement

- Determine new controls

- Finance controls

- Implement new controls

Risk is multi-dimensional. It has intertwined causes, consequences and controls to start with.

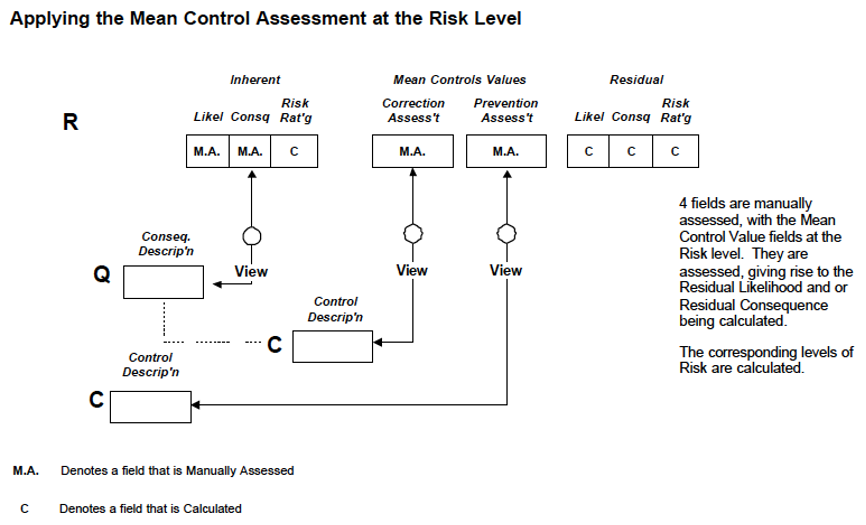

Calculations built into the software are predicated on using in-built modes of assessment as well as user defined calculations.

The application is a forerunner in setting standards to cater for calculations that span the risk process from inherent risk (representing a failure mode) to residual (i.e. the current state) and target risk (desired) levels using different modes of assessment. The premise of these modes of assessment is that the risk analysis evolves over a life cycle and there is an appeal to build more accurate pictures of risk exposures.

Methods & Steps are designed in the application to allow the process to follow a structured and methodical process when engaging in an assessment. Each method allows for customizing virtually an unlimited number of steps.

The Risk Matrix: Probability

A Risk Matrix is an essential tool in assessing risks. Whereas most software applications provide a static and fixed risk matrix, our software provides unparalleled flexibility to design your own risk matrix. A Risk Matrix has two dimensions, Likelihood (Probability) and Consequence (of an adverse event).

Since most software programmes provide risk matrices that are static i.e. pre-defined – our software for PRM stands apart and excels. It lets the user define a matrix with customised parameters. This is made possible by handing over total control on defining a Risk Matrix and its components, which are: Probability and Consequences and how these two interact to arrive at a risk score.

The Concept of Escalation

In risk management parlance an escalation means that someone may not have performed something to plan and an escalation is needed to forewarn the expert/professional or medical practitioner who has oversight responsibilities for the matter, so that backup action may be set in motion.

Personal Lifestyle Exposure Planning, makes use of the principles of financial planning and personal risk management (PRM) in a holistic personal planning approach to provide you with total financial, health and security peace of mind.

Personal risk management is a combination of the science and art of enterprise wide risk management, financial planning and personal wellness.

Within these 3 disciplines, you select the risk categories most relevant at this time. The risk categories provide the basis for your tailored and client-specific personal life plan (PLP) report.

Appointment to Include:

- A comprehensive financial analysis and risk management control plan that reflects the current situation and recommendations in alignment to your current objectives;

- Revision of your last will and testament to determine whether it is enforceable and aligned to your financial objectives and succession;

- Revision of current investments platforms, the costs being incurred in the fund which minimize performance and, whether the asset allocation is appropriate to your risk profiling;

- Ensuring and assisting with a Medical Aid plan assessment and move to an appropriate plan to cover your particular needs;

- Assist with a budgeting exercise and planning to ensure that expenses are within budget allocation;

- Provide a plan to upskill and educate you in the financial planning environment so that you can comfortably and confidently make informed decisions.

SERVICE LIST

NEED HELP?

Coach & Practitioner

Executive health strategist and natural wellness practitioner.